We know insurance can be a painful topic, but there’s no need to panic.

Insurance for self storage is a lot easier to understand than, say, your medical insurance. Even so, you (or your tenants) may have some questions about insurance in the self storage industry. Should you require it? Should you offer it at all?

We’ve got the details on some of the major questions revolving around self storage insurance.

Tenant Insurance for Self Storage Units

Let’s talk about insurance.

Not the insurance that you’re taking out on your property for your self storage business. We’re talking about the insurance your tenants pay for that covers the property they store with you.

There are all sorts of things that can go wrong at a self storage facility that are almost entirely outside of your control: natural disasters, fires, break-ins, and so on.

So, what are some of the big questions around self storage insurance—and how can software and other methods help?

Return to Top

Do I need to require insurance when leasing a storage unit?

Before we get any further in, let’s be on the same page about the legal sides of self storage: laws change all the time, and they are often different depending on where your business is located.

To get the best advice about what you’re legally responsible for, make sure to consult with an attorney and/or your local self storage association.

That will be the best way to limit your self storage liability.

With that said, there are many reasons why you should require your tenants to have insurance for their self storage unit.

Often, renters will be blindsided by the fact that their property isn’t automatically insured when stored with you. You may include that they are responsible in your lease agreement, but people often don’t read their lease in enough detail to catch these facts!

Requiring self storage insurance coverage is the best way to protect yourself from angry customers and the potential for legal complications.

It’s also just a great way to make sure your tenants protect themselves when they don’t know better.

Return to Top

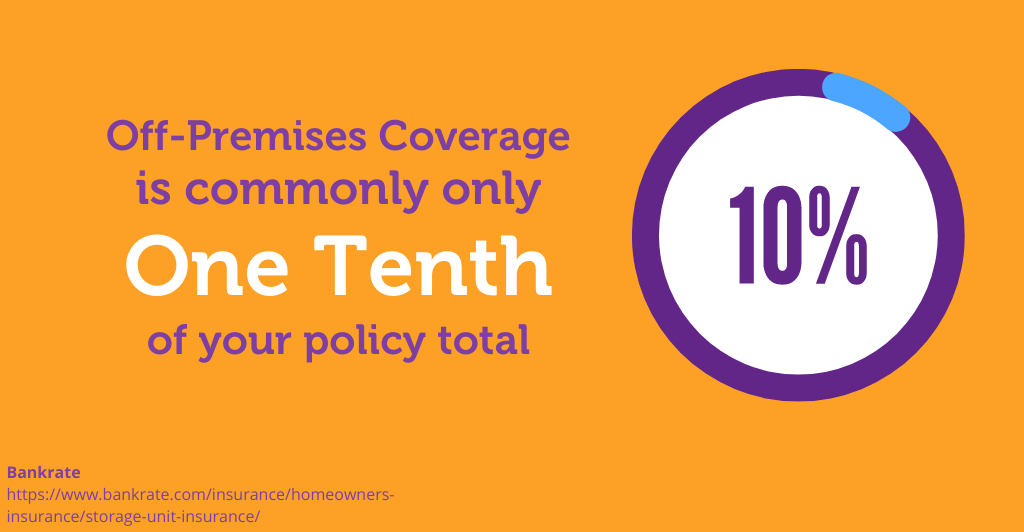

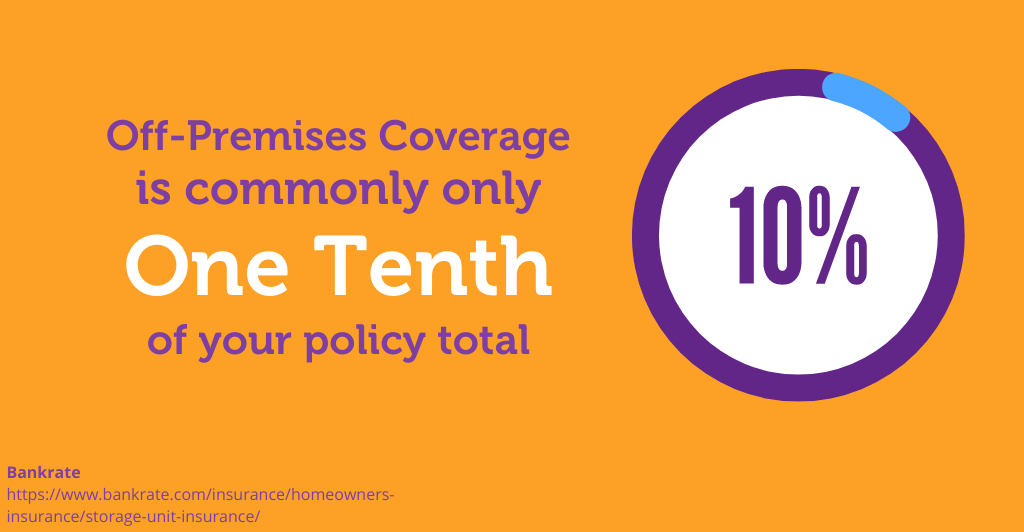

Do homeowners’ or renters’ insurance cover items in a storage unit?

If you want to make sure your tenants’ property is covered, then should homeowners’ or renters’ insurance be good enough?

Does homeowners insurance cover storage units?

It’s possible that their existing coverage does cover the loss or damage of property inside their self storage unit. However, these insurance plans often have key downsides:

- Their coverage isn’t usually as encompassing as self storage insurance

- Costs can go up in the case of property loss or damage

- These other plans typically include high deductibles

For all the reasons mentioned above, it’s in your best interest to ensure your tenants are protecting themselves.

If nothing else, it shows that you care about your tenants, and everyone wants to feel cared for!

Return to Top

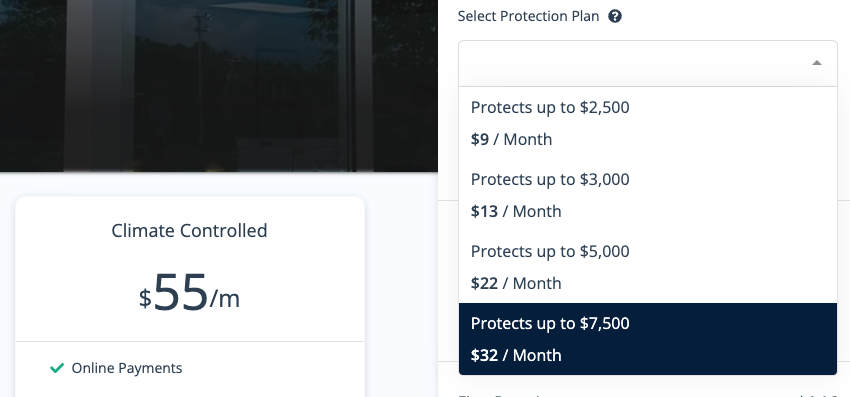

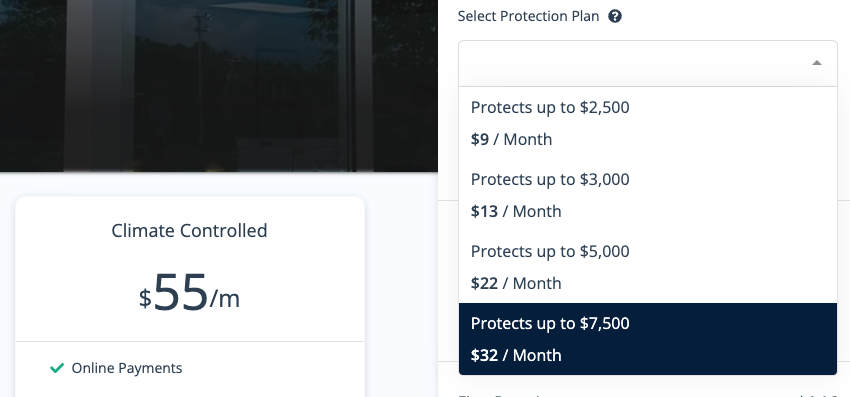

What is a tenant protection plan?

You may have heard the words “protection plan” or “tenant protection plan” thrown around.

A tenant protection plan is when a tenant pays the self storage operator an additional fee on top of their monthly rent to be covered for damages to the property they store at the facility.

Typically, these operators then take out an insurance policy with a third party to cover the items stored in the storage unit.

In some states, these agreements are not legally referred to as insurance. That’s where the term “protection plan” comes into play.

These plans are a great option for both tenants and self storage operators.

Rather than requiring a renter to go out of their way to find their own self storage insurance, they can just opt-in to pay the self storage facility directly for coverage with their monthly rent!

For the self storage business, it can be marketed as a convenience feature. It also means your tenant is more likely to have coverage for their items (which means less headache for you in an emergency!).

Alternatively, you could choose to make this coverage a requirement for renting. Rather than attempting to explain the need for a self storage insurance policy or tenant protection plan, you can tack it on as an additional part of the leasing process, explain the reasons for the fee, and know that every tenant at your self storage facility is covered the same way.

Return to Top

What should be covered by insurance for self storage units?

Just like with a home, any number of natural (or unnatural) disasters can occur.

So, what kind of things should be covered by insurance? This is an important consideration if you plan on offering a tenant protection plan. It can also be helpful if you allow outside insurance policies and choose to require specific events to be covered.

Here are some events you probably want to be covered by your self storage insurance (or tenant protection) plan:

- Fire damage

- Burglary

- Water damage

- Collapse

- Vermin

- Vandalism

- Explosion

- Natural disasters

This isn’t an exhaustive list, but it should get you headed in the right direction.

Return to Top

Is there self storage software or other technology to help?

Currently, there isn't any real self storage insurance software specifically. When it comes to the crossroads of technology and self storage insurance, you are basically looking at two fronts:

- Sign-up

- Storage

When it comes to getting tenants signed up for a protection plan (or delivering their proof of insurance), you have a few options.

For protection plans, you may be able to add this as a step in your online rental process.

For both protection plans and self storage insurance, you can probably incorporate fields for them to sign up or enter proof of coverage when completing an eSign or other digital lease format.

In regards to storing this information, digital cloud storage is important for proof of insurance. If your self storage PMS or other software includes integrations or easy databases for keeping track of the coverage your tenants have, that means a lot less legwork for tracking the information yourself.

In the case of a break-in, fire, or other disasters at your self storage facility, there is a high probability that physical records could become compromised or lost entirely. Cloud storage will ensure that damaged papers or computers don’t result in loss of access to the information.

Regardless of how you choose to manage your self storage insurance or protection plan data, there are many reasons you should require insurance at your self storage facility!

Check out these other great posts about running a self storage business!

At StoragePug, we build self storage websites that make it easy for new customers to find you and easy for them to rent from you.

![[BASICS] 5 Minute Data & Reports for Self Storage Featured Image](https://cdn.storagepug.com/hubfs/%5BBASICS%5D%205%20Minute%20Data%20&%20Reports%20for%20Self%20Storage.png)