Proper accounting for your self storage business helps you run your business more successfully at every level.

The best part? There are robust software packages available to help make accounting as easy as possible for you! Not all of it is self storage accounting software, either—while your self storage software may have integrations with your accounting software, the most powerful accounting tools are actually applicable to business in general. You may even have ones you’re familiar with from other industries that will work just fine for your self storage accounting needs!

What is accounting, really?

According to Bench, “accounting is how your business records, organizes, and understands its financial information.”

So what does that mean for your self storage business?

Well, there are four major parts to your self storage accounting:

- Bookkeeping

- Financial reporting

- Auditing

- Tax prep

These ideas may sound scary. Maybe reading them makes your brain start to roam, or your eyes start to glaze over.

Don’t worry, they’re not that hard to get down—and we’ll tell you how to make it even easier (using software and other methods).

Return to Top

1. Bookkeeping for your self storage business

Picture this scenario:

It’s Monday, and you start your day by opening your self storage PMS and reviewing the payments that came in online over the weekend.

While you’re doing that, the contractor arrives—they’re here to fix a section of your security fence damaged in the storm last night.

Later that day, you stop by the store to grab some lightbulbs over your lunch break. A few of the lights were out in the office, and you didn’t have any spares on hand.

That evening before closing, you finally get the payment from that tenant you’ve been chasing for almost two months now.

It’s easy to keep track of all of these in your head now, but what happens when you go through 7 days of this? 30? 365?

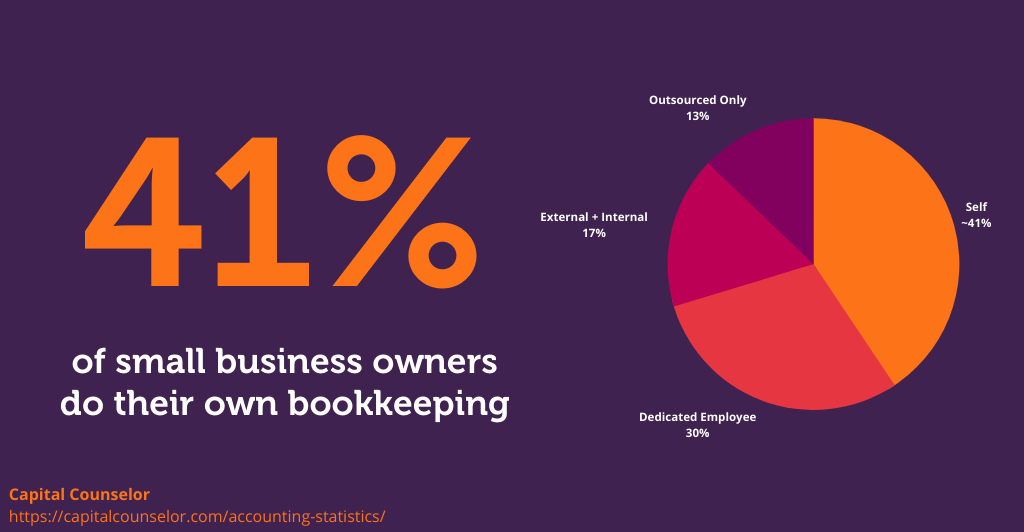

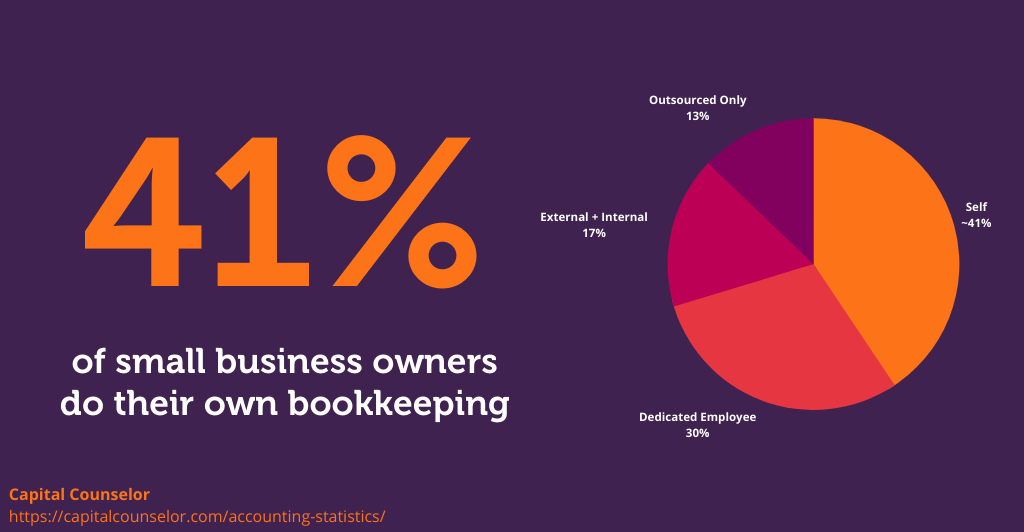

Proper bookkeeping means keeping a record of all of your business’s transactions. This means debits AND credits. Not just payments from tenants, but also every other financial transaction involved in your self storage business.

You want to keep the source records—receipts, invoices, and similar documents—and also maintain a secondhand record of revenue and expenses as an overview. Usually, this ends up being in spreadsheet form.

Thankfully, there are many types of software that can make it easier!

To start, your existing self storage software likely keeps records related to your customer-facing transactions.

For your back-end accounting needs, there are many self storage accounting or just general bookkeeping software packages to choose from.

Return to Top

2. Your self storage business's financial statements

A financial statement or report helps you see the overall picture of your business’s financial successes and challenges.

Put another way: financial statements are like a health chart for your self storage business.

Without proper financial statements, determining how successful your business is can be extremely difficult.

You will also want good financial statements if you intend to apply for a business loan or ever hope to sell your business. These records help prove the value of your self storage business.

Make this whole process easier using accounting software like QuickBooks.

With good self storage software and account software, you should have integrations that allow them to communicate and build reports without a lot of extra work.

If they don’t integrate, most accounting software will also allow you to import spreadsheets, and your self storage software may allow you to export spreadsheets!

Return to Top

3. Self storage audits

The word audit is bound to make many people get goosebumps.

Auditing isn’t a bad word, though—it just means making sure your records match the reality of your business.

If you want to keep proper records for all the reasons listed above, then you also want to make sure they’re as accurate as possible! That means tracking all three types of self storage occupancy.

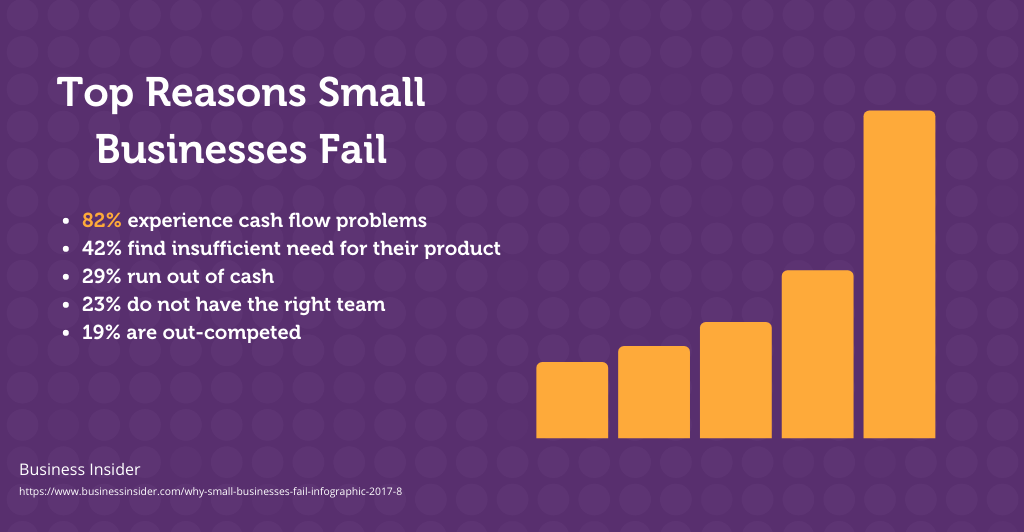

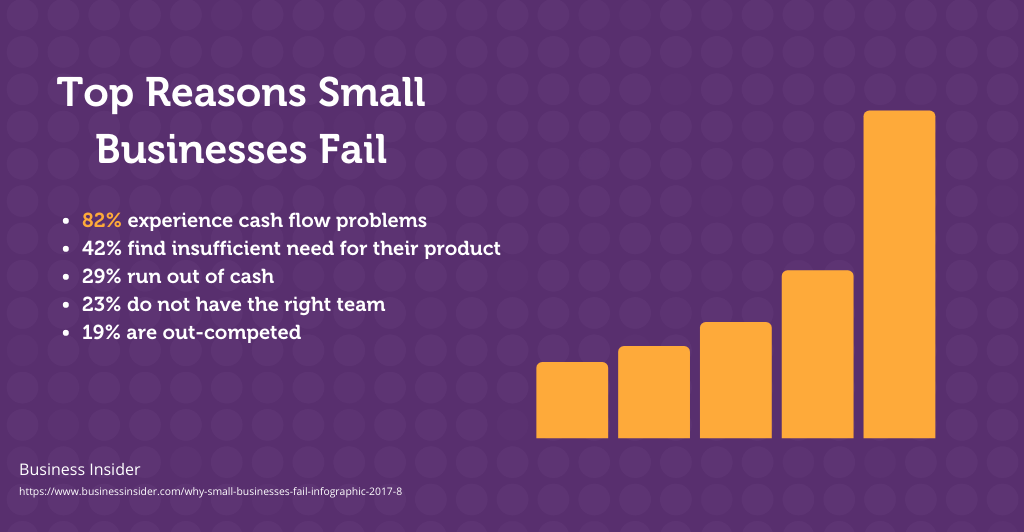

Auditing can also help you improve your cash flow.

You can even audit your own records.

If you want the best results then you really want to hire an independent auditor to review your self storage business and financial statements. Sometimes there’s just a blind spot you’re missing, and getting someone else to take a look will help identify those blind spots.

It helps to have digital records—especially stored on a cloud—when you want to perform an audit. Not only are digital records easier to access and search through, but you can even give access to someone without them having to physically travel to your office.

Another benefit of using self storage accounting software is that it creates these digital records for you.

In many cases, this software includes cloud storage for your records, so you don’t even need to worry about finding the file storage method on your own.

Return to Top

4. Your self storage business's taxes

It’s tax season.

Are you ready for it?

If you find yourself scrambling and panicking when it comes time to do your self storage business taxes, then it’s likely you need better bookkeeping and financial records.

You may also want to consider outsourcing this part of your business’s accounting to an independent accountant or accounting firm, which is made easier with cloud-based accounting software.

Similar to the auditing process, you can perform bookkeeping and generate your own financial statements, then give an accountant access to them to file your taxes for you!

Using accounting software for your self storage business will significantly decrease the work and stress revolving around business taxes.

Some of the more complicated tax strategies, including calculating self storage depreciation and cost segregation, may still require the help of an accountant.

Return to Top

Wrapping up

Proper accounting for your self storage business gives you a full picture of your business’s financial health.

This allows you to determine if your business is financially successful and stable, and it enables you to find places where you could generate more revenue or reduce expenses. Solid accounting practices can also help you with self storage time management!

The entire self storage accounting process works almost like a cycle, and each step makes the next step easier and less stressful!

Proper bookkeeping lets you generate financial records. Auditing ensures your financial statements are accurate. With accurate financial statements backed by independent audits, you can confidently (and easily) prepare your business’s taxes.

The right self storage accounting software greases the wheels at every step of the process.

Check out these other great posts about running a self storage business!

At StoragePug, we build self storage websites that make it easy for new customers to find you and easy for them to rent from you.

![[BASICS] 5 Minute Data & Reports for Self Storage Featured Image](https://cdn.storagepug.com/hubfs/%5BBASICS%5D%205%20Minute%20Data%20&%20Reports%20for%20Self%20Storage.png)