Highlights

Foundational marketing strategies to have in place - whether leasing up or stabilized:

- Website

- Set up listings (Yelp, Google My Business, Apple Maps)

- Social Media

- Establish Local Partnerships

Lease up marketing strategies:

- Lead Generating Strategies (like digital ads)

- Aggregators (Sparefoot, Storagefront, etc.)

- Awareness Campaigns (like billboards, flyers, and sponsorships)

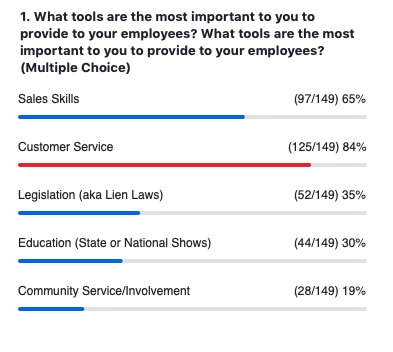

Your average customer value

Find the average stay length of all tenants. Next take your economic occupancy and divide by how many units you have. That will tell you what the average customer pays.

Multiply the average length of stay by what the average customer pays, and that's the average value of a customer.

For example, if a customer stays for 12 months and pays $100 per month, then their value is $1,200.

Your average lead value

Figure out your closing rate (or conversion rate) i.e. how many leads do you turn into tenants? Multiply that by your average customer lifetime value to figure out what your leads are worth.

Pro Tip: see which lead sources are converting the best. It may be that certain sources have a higher conversion rate, so those leads are worth more to you than a source that barely converts.

Typical Lease-up timeline

According to our panelists, it's typical to see a 3-4% increase each month, putting your facility at 36% after the first year, and 72% after the second.

Alternately, you can look at your lease up goals through the lens of your units, aiming for 20 units rented per month.

For Nick and StorageMax, they pro forma their economic occupancy at 85% with their sweet spot at 92%.